Libertarian President of Argentina, Javier Milei, has quietly withdrawn and shipped abroad almost all of the country's gold reserves.

Libertarian President of Argentina, Javier Milei, has quietly withdrawn and shipped abroad almost all of the country’s gold reserves.

«There is no silver». With that compelling phrase and a chainsaw in hand, Argentine President Javier Milei addressed thousands of people gathered to hear his first speech on December 10, 2023. Six months have passed since those words, and the country is now without gold.

The latest data, published on June 7 by the World Gold Council and the International Monetary Fund, estimated Argentina’s gold reserves at about two million troy ounces (about 61.7 tons). Suddenly it was revealed that the gold had disappeared. In the «Consolidated Report of Assets and Liabilities», the Central Bank of Argentina (BCRA) reported that as of July 23, 2024, its gold reserves («excluding forecasts») were equivalent to approximately $4.771 million USD at the official exchange rate of that date. The country ranked 50th on the list of the world’s top 100 gold holders. But these figures were no longer accurate.

The alarm was raised by Sergio Palazzo, the leader of the La Bancaria bank workers’ union and a Peronist deputy, who on July 15 sent a request to the Central Bank under the law on access to public information, asking whether «any operations to send gold bars abroad were carried out in June». Specifically, he wanted to know if gold transfers had taken place on June 7 and 28 via a British Airways flight through the private security company Lumil (Securitas Cash Handling Services), which handles the transportation of valuables. He also wanted to know the exact amounts, their purpose, the administrative procedures involved, and the names of the officials involved.

The BCRA remained silent for 30 days, as it is entitled to do by law. Then, on July 29, Palazzo sent another request, asking whether the central bank planned to carry out «operations to send gold bars abroad» in late July or early August, and «if so, in what quantity, for what amount and in what currency». If Palazzo’s suspicions are confirmed, three batches of gold were sent abroad.

This caused an uproar among Argentinians. The question on everyone’s lips: where is the gold? Has it been taken out of the country, and if so, how much? Where was it sent, and how vulnerable are the bars to seizure by international creditors?

In a climate of financial instability, where the government is faced with the need to accumulate reserves, a positive response from the authorities has raised suspicions of government speculation. There are also fears that the gold could be confiscated as a result of long-standing lawsuits against Argentina by foreign creditors.

The government of far-right libertarian President Javier Milei remained silent for three days, then admitted that the gold had been sent abroad, but did not disclose the amount, destination or purpose of the operation. The central bank also provided no details.

Economy Minister Luis «Toto» Caputo, «with the arrogance and impunity characteristic of this government», wrote the Argentine newspaper Pagina12 in an interview with La Nacion+ television, called the central bank’s move “extremely positive». «The reality is that the country needs to maximize the return on its assets. If you have gold, you can get it back. It’s unprofitable to keep it at home; it’s much better to store it abroad where you can earn something», he said.

In a statement released by Argentina’s main opposition force, the center-left Union for the Homeland (Unión por la Patria), the president of the BCRA, Santiago Bausili, was asked to “urgently” explain the reason and the amount of gold exported from the country. The opposition also asked about «the risks associated with the operation» and «the possibility of the gold being seized during transport or at the bank where it was sent».

It is suspected that «hostile» London served as a transit point while negotiations were conducted with the Bank for International Settlements (BIS) in Basel, Switzerland, which offers dollar loans only to those who leave gold as collateral.

Exporting Argentina’s gold abroad is nothing new. In 2017, the country transported 11,000 kg of the precious metal, worth about $450 million, in order to profit from «renting it out». However, the return cost was already $600 million.

Minister Caputo’s statement reflects the desperation of the Milei government as deadlines approach for large debt repayments next year, which Broda’s research shows will rise to $17.5 billion.

President Milei himself indicated that the gold was given as collateral for a temporary loan. «The president said that Argentina already has enough US dollars to pay the interest on its foreign debt — a payment of about $1.6 billion — that must be made in January 2025», writes Spain’s El Pais. «He claims that the temporary loan will also include the payment of an additional $3 billion to foreign creditors».

In just the first five months of Javier Milei’s government, the Treasury’s total gross debt increased by $65.01 billion, or 18%, reaching $435.674 billion in May of this year.

Milei later stated that the government intends to use the REPO resource as a way to obtain dollar liquidity to meet these repayment deadlines. In the financial markets, REPO (repurchase agreement) refers to a transaction in which securities are sold by one party to another with an agreement to repurchase them at a predetermined price. In traditional REPOs, the price is fixed for the entire term of the transaction.

The problem is that in the short term, the money obtained must be returned — the dollars must be surrendered to get the gold back. If someone fails to raise the required amount, the pawnbroker (in this case, the international bank) keeps the country’s gold.

In other words, Milei and Caputo intend to exchange reserve gold for paper dollars in order to pay interest on the foreign debt.

In doing so, they are demonstrating that they do not have the currency to repay and that Javier Milei’s government is trying to gain access to loans.

This maneuver is nothing more than a desperate attempt to prove solvency to foreign creditors. And it is a maneuver that could prove very costly. In times of currency instability, gold remains one of the most stable reserves of value. While most major investment funds and countries seek to preserve their gold reserves, Milei is decapitalizing the country.

This financial maneuver by the ruling tandem has other problems as well.

First, it is unlikely that the funds to finance the REPO payment will be found in the short term. In that case, the «pawnshop» will keep Argentina’s gold.

But another, no less significant, risk is the seizure of the gold already stored in London as a transit point, pending negotiations with the Bank for International Settlements in Basel to secure loans against the gold.

If some $4.5 billion worth of gold is essentially being pledged as collateral, where will the money come from to buy back the gold? Finally, the fact that the authorities are drawing on the country’s gold reserves suggests that Argentina lacks sufficient liquid assets and is therefore forced to draw on its most precious and, above all, last treasure — gold — to pay the country’s current debts.

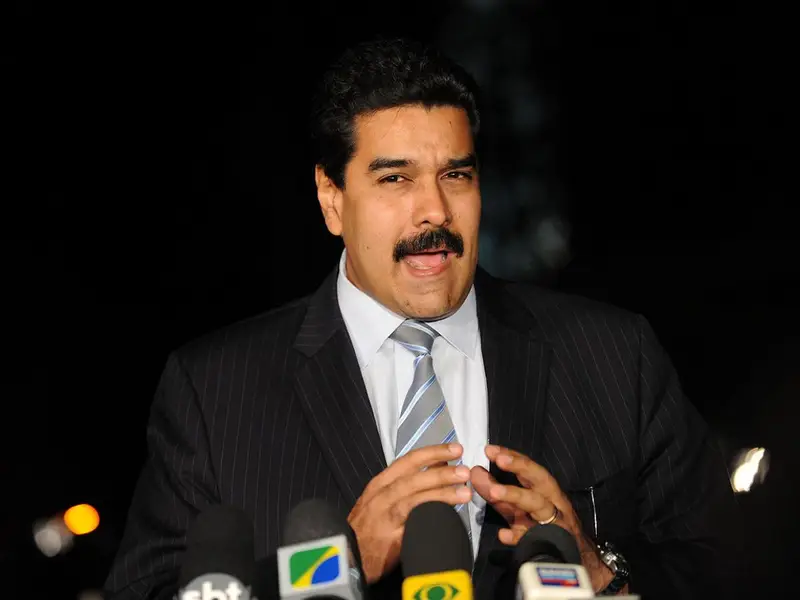

The former vice president of the Central Bank of Argentina, Jose Carrera, expressed concern that «the transfer of Argentina’s gold reserves to another jurisdiction, such as the United Kingdom or the United States, requires the decision maker to be certain that there is no risk of an embargo». «Remember the story of Venezuela’s gold reserves in the UK, which, believe it or not, were handed over to the so-called ‘legitimate government’ of Juan Guaido, or the story of Russia’s $300 billion in the EU. Or the BCRA’s embargo on assets at the Federal Reserve Bank of New York for several million dollars, which took a long time for the BCRA to recover», Carrera recalled.

And there are precedents. Argentina’s national reserves have already been targeted by foreign courts. The country faces numerous unfavorable judgments abroad. Some of them date back to 2012, when the oil company YPF was nationalized, or even to 2001, when Argentina defaulted on its debt.

Economist Juan Valerdi told Sputnik that the decision to send gold abroad is a sign that the Milei government is «desperate» in its search for access to credit, which it has failed to achieve in more than six months of governance.

«If Argentina misbehaves with NATO, or if a government comes to power that the U.S. doesn’t like, they will automatically confiscate that gold, just as they did with Russia and are likely to do with other countries», he added.

In May, in Madrid, Javier Milei presented his book «The Libertarian’s Path» and reaffirmed his electoral economic «chainsaw» promises, specifically to implement his plan to «close the Central Bank, dollarize the economy and significantly reduce the state». He also spoke about currency competition and promised to eliminate «currency action».

Meanwhile, the central bank is beginning to implement its new monetary policy of «zero issuance» — no more printing pesos to finance the extension of obligations totaling about $20 trillion. It is quite possible that the export of the country’s gold reserves is more closely linked to these decisions.